Tips on receiving money from overseas Zyla

International suppliers or overseas parent companies sometimes ask for payments to be sent in Australian dollars. We can work with you to get the transfer sent as fast and smoothly as possible. You can call us for a quote or to chat about the different options available. 1.

How to Receive Money from Overseas in Malaysia Article HSBC Business Go

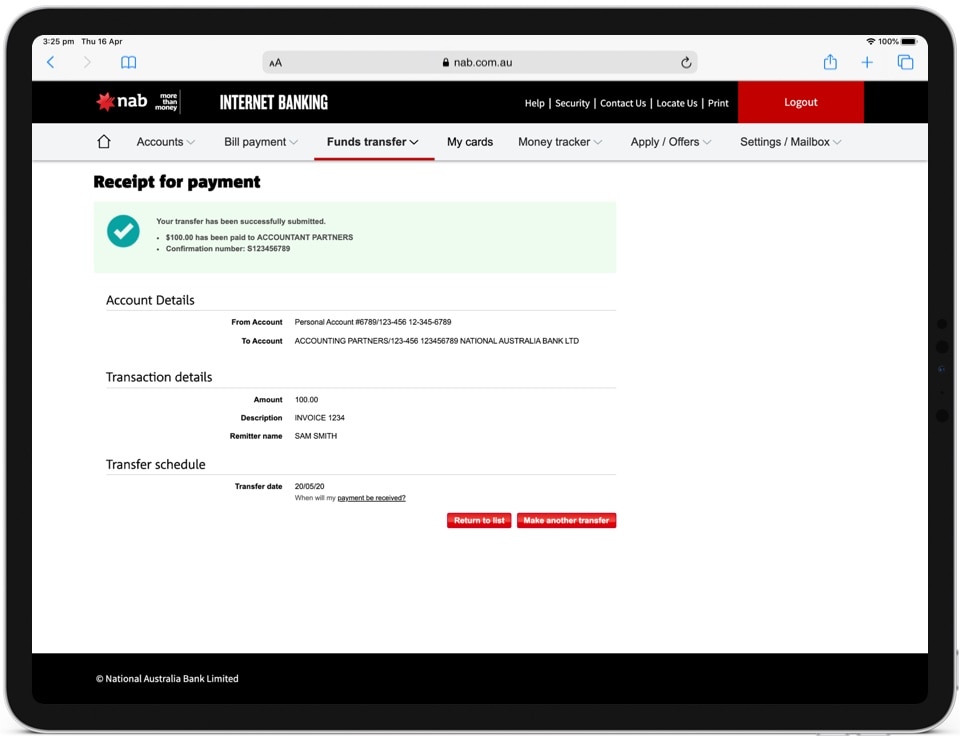

Receiving bank fee - NAB is one of the few banks that absorb the fees that receiving overseas banks may charge. Sending provider or bank fees — International money transfers sent from an overseas bank or currency exchange provider may be subject to commissions, fees and other charges. These are typically deducted before the money is sent to you.

How to Receive Money from Overseas Using TransferWise

Send money overseas. Send money around the world with a $0 international transfer fee when you use the NAB app or NAB Internet Banking and send the money in a foreign currency. 1. Track payments 2. No minimum transfer. See how to make international transfers easily with NAB.

Receive money from abroad in the United Kingdom Receive money from overseas Wise

Transfer your money securely overseas using NAB Internet Banking or the NAB app. $0 transfer fee when sending in a foreign currency. Learn more about international transfers.. To receive an international money transfer into your NAB account, you need to give the sender these details: Bank: National Australia Bank;

How To Send And Receive Money From Overseas Travel BLAT

NAB Fees. International money transfer via NAB Internet Banking (in foreign currency) A$ 10 ⁺. International money transfer via NAB Internet Banking (in Australian dollars) A$ 30 ⁺⁺. Banker assisted. A$ 30. Requested by email or fax - email and fax written instructions will only be acted on where an Email/Fax Authority is held.

How to Safely Receive Money from Overseas Jeton Blog

To make an international transfer you need to have SMS Security switched on, which you can do via settings in NAB Internet Banking. You can check your international money transfer limit in the NAB app or through NAB Internet Banking, and you can amend this by giving us a call at 13 22 65. Or, if you're overseas, call +61 3 8641 9083.

8 things to consider when receiving money from abroad PaySpace Magazine

cash pick-up. PayPal. 1. Bank-to-bank transfers: receiving money in your bank account. This is the most common method for receiving money in Australia and involves your sender's bank overseas to transfer the funds to your bank account in Australia. It is also referred to as a telegraphic transfer or a wire transfer.

How to receive money from overseas as a business WorldFirst

International money transfer services. An international money transfer is a secure and simple way to receive money from overseas, in any chosen currency. You can receive money from overseas directly into your bank account by using an international money transfer service. All which would be needed is the recipient's bank and personal details.

Receiving Money From a Foreign Country A Guide for Beneficiaries

Service required. NAB foreign currency account fee. Intra-account transfer. $30 for an over the counter transaction$20 for online transactions not including a currency conversion$10 for online transactions with a currency conversion⁷⁺⁸. Receiving an international payment.

Guide to receiving money from overseas Compare the Market

1. Bank to bank transfer. You can receive money from overseas through one bank account to another. The sender will have to initiate the transfer from their bank account through online or mobile banking. As the receiver, you need to provide details including your name, residential address, your account details (BSB, account name, account number.

√ How Do I Transfer Money from UOB to Overseas Bank

National Australia Bank charges a very simple fixed fee structure for international money transfers sent abroad from Australia using NAB Internet Banking or the NAB mobile app: An AU$10.00 fee for funds transferred from Australian dollars into a foreign currency; An AU$30.00 fee for funds transferred into a foreign bank account in Australian.

Using NAB to Transfer Money Overseas Is it the Cheapest Option? YouTube

1 — Bank Deposit. Thomas Lefebvre on Unsplash. The most common way to receive money from overseas is via bank deposit, which takes place when the sender of a currency transfer makes a bank wire (or another type of bank transfer) from their bank account to yours. In most cases, bank deposits are the receiving side of an international wire.

9 Ways to Receive Money From Abroad in Pakistan Requirements

As a foreign currency disbursement. Incoming international transfer: $12. Payment of an international transfer by cheque or cash: $22. Foreign currency disbursement: $50. Westpac doesn't guarantee any transfer times, so like any other SWIFT transfer, you can expect it to take around 3-5 business days. NAB.

Nab Credit Card Overseas NAB adds serious style to new Platinum Visa Debit Card DESIGNS

The five main methods to receive money internationally are banks, currency brokers, digital multi-currency accounts, remittance companies, and digital wallets. The best way to receive money from overseas depends on individual needs, but banks are rarely the best option. When a currency exchange is required, consider if you want to have any.

How To Receive Money From Overseas Best Ways in 2024

As with most banks, NAB will charge you a fee to receive money from overseas. Here's what you should expect to pay:¹. Receiving a transfer. Fee. Deposited into a NAB account. Up to AU$15 per transfer. Deposited into a non-NAB account in Australian dollars (NAB acting as the intermediary bank) Up to AU$30 per transfer.

How to transfer money banking help guide NAB

NAB fees for receiving money from overseas. One of the most important things you need to know, is how much the process is going to set you back. Below, we've looked at how much it costs to receive money from abroad with NAB: Transfers to a NAB account can cost up to $15. Deposits to a non-NAB account with NAB acting as intermediary can cost up.

.